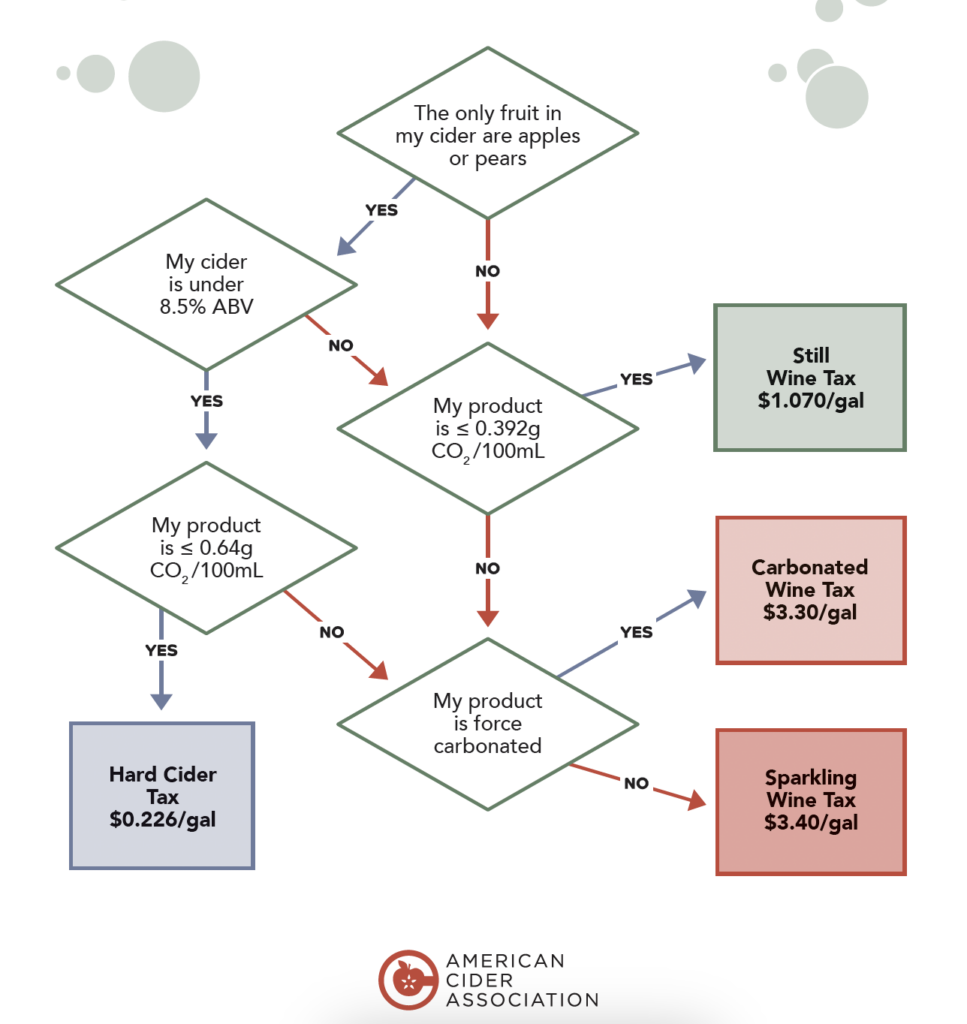

America’s tax code is notoriously that modern drinkers have grown to expect beer-like carbonation levels in their alcoholic beverages, thereby creating pressure for cider makers to add more carbonation to their products.

One cider maker from Oregon reported that he receives frequent emails from consumers complaining about flat cider, which they incorrectly blame on him rather than the government. If adding more carbonation could financially cripple a small business, it’s little wonder many cider makers feel that their hands are tied.

The disparity is glaring when compared to beverages like beer, hard seltzer, and regular soda, which face no such carbonation-based tax penalties. It’s a clear disconnect from market realities and consumer demands, which increasingly favor diverse flavors and more carbonation in ciders.

Craft cider makers are doing their best to diversify the carbonation levels and fruits in their ciders to respond to consumer demand, but it’s clear the industry has a hard ceiling on its growth due to these tax rules. This is why many cider makers state that their ability to expand—and the ability of the industry as a whole to thrive—is being pointlessly inhibited.

The bubble tax is now getting more attention due to a recent bipartisan bill introduced in Congress, which aims to level the playing field between apple and pear ciders and those made with other fruits. While promising, the best reform would be to convert the entire system of alcohol taxation to one based simply on a drink’s ABV level rather than arbitrary classifications.

Craft cider, a beverage steeped in American history, deserves better. Another Michigan cider maker made it even simpler: “It’s not expressing the free market. The government needs to get out of the way.”