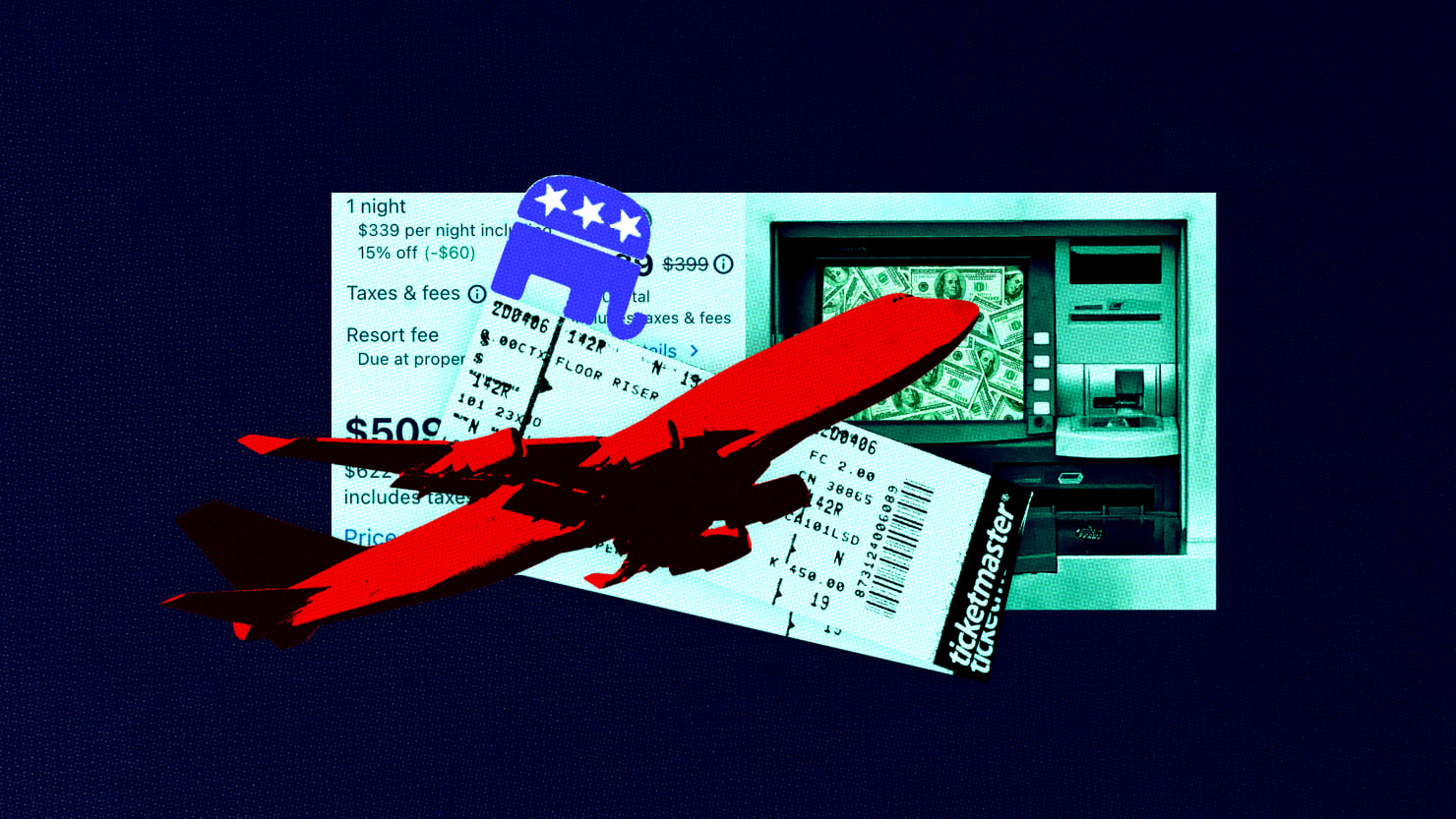

In an era of “fee-flation,” it seems like Americans can’t make a single purchase without junk fees being added at checkout.

From massive fees for consumers who switch internet providers, to concert “service fees” that can reach up to 20 percent of the tickets themselves, American consumers are paying the price for corporate greed.

In his State of the Union speech earlier this month, President Joe Biden outlined a number of policies to help working-class Americans, including a ban on predatory junk fees. Alongside calls to ban noncompete clauses and rein in Big Tech, Biden’s address marks a rare instance of a president using their platform to take on corporate abuses.

From a political standpoint, it’s hard to imagine that the issue won’t be a winner with the American public. After all, regardless of whether you’re a liberal or a conservative, you’re probably not too happy when a hotel puts a previously unannounced “resort fee” on your bill after you’ve already checked out. As explained by the White House, junk fees exist purely to “confuse or deceive consumers,” or to take advantage of “situational market power.”

Nevertheless, both conservatives and corporate lobbyists have fought hard against efforts to ban predatory junk fees. With the Republican Party desperately trying to rebrand as a party of the working-class, the GOP would be wise to side with American consumers, not companies that overcharge them at every opportunity.

While former President Donald Trump only rhetorically hammered the big banks, Republicans have consistently gone to bat for their right to saddle consumers with junk fees.

Last year, every single Republican on the Senate Banking Committee signed a letter skewering the Consumer Financial Protection Bureau (CFPB) for trying to curb predatory overdraft fees. In the letter, the GOP senators accused the agency of mounting a “relentless smear campaign against banks” over purportedly “optional overdraft services.” Amusingly, Republicans on the House Financial Services Committee also feigned outrage last year about the CFPB’s effort, describing the agency’s actions as an “attack” on the “services Americans rely on.”

As noted in a report by advocacy group Accountable.US, congressional Republicans on both committees have parroted talking points identical to the bank industry’s own to defend overdraft fees. According to the report, the relevant members of Congress have received over $3 million in career donations from leading banks and industry groups supportive of overdraft fees. The report also identifies a revolving door between Republican staffers and industry groups supportive of overdraft fees.

Besides Republican elected officials, both right-wing think tanks and industry lobbyists have been willing to bat for junk fees. After the State of the Union, the president of the Consumer Bankers Association (CBA), a leading bank lobby group, went on air to bat for overdraft fees. In a tweet accompanying the clip, the CBA’s Lindsey Johnson described overdraft fees, which disproportionately harm the poorest of consumers, as fees that “support hardworking Americans.” Similarly, an official from the conservative-leaning American Enterprise Institute (AEI) went on CNBC to disparage Biden’s efforts to ban junk fees as dangerous populism.

But the Biden administration’s effort to ban junk fees are anything but an assault on capitalism and consumer choice. On the contrary, when corporations tack on unadvertised junk fees to products or services, they’re deliberately obfuscating consumers’ ability to compare and consider costs.

In other words, if a hotel offers a deal for a three-night stay, but doesn’t include the cost of mandatory “resort fees” in the advertised price, the company is intentionally distorting the market.

In fact, it’s for this very reason that banning junk fees has been a key goal of the Biden administration’s competition agenda announced in his first year in office. While antitrust concerns have mainly centered on the tech industry, the rise of modern monopolies across a variety of sectors has enabled big corporations to charge junk fees.

A timely example is Ticketmaster, an unaccountable corporate giant whose monopoly position in the ticketing industry enables the company to charge exorbitant junk fees.

Published in 2019, Consumer Reports’ “WTFee Survey” remains perhaps the most comprehensive survey detailing Americans’ experiences with junk fees. Conducted through a survey of over 2,000 Americans, the results of the report make Americans’ distaste of junk fees loud and clear. Sixty-nine percent of respondents said they experienced junk fees from telecom providers from 2017 to 2019, and over 40 percent said they faced unexpected or hidden fees from live entertainment and energy fees.

But the most alarming aspect of the Consumer Reports survey was that around six in ten respondents said that junk fees caused them to exceed their budget.

At a time when millions of Americans face food and housing insecurity, hidden or deceptive fees that exist purely to gouge consumers means junk fees are harming the most vulnerable. As Biden explained, “Junk fees might not matter to wealthy people, but they matter to most folks like the home I grew up in.”

Putting the ethical issues aside, with the 2024 presidential campaign cycle set to kick into gear, Republicans would be unwise to tie themselves to the cause of defending junk fees.